Hedge Fund Prospectus Templates Microsoft

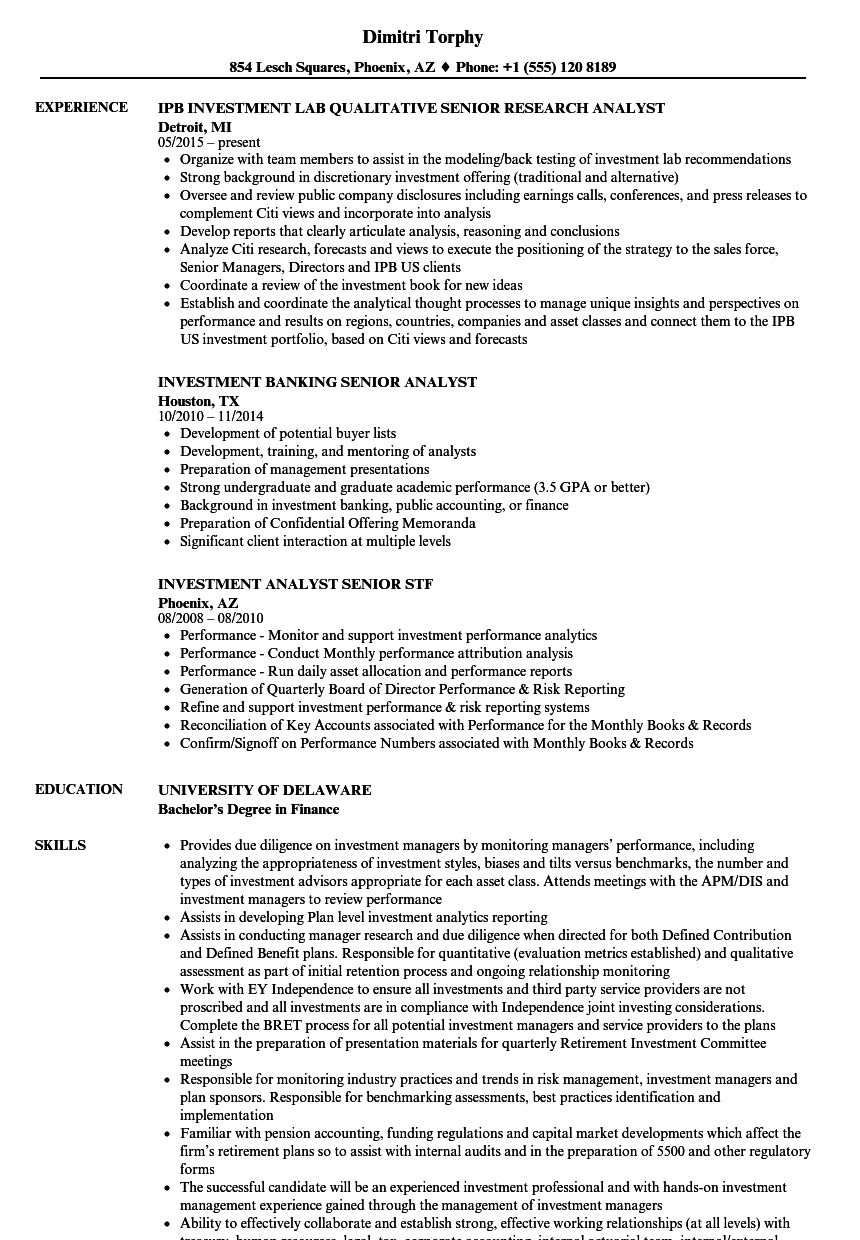

The central reason that beginning hedge fund managers need a lawyer is that the lawyer will prepare the offering documents for the fund. The offering documents are designed to comply with the requirements of the federal securities laws as interests in the fund (whether the fund is a limited partnership or a limited liability company). Specifically the offering documents will most likely be drafted to conform to the requirements of Rule 506 of Regulation D under the Securities Act of 1933.The offering documents are the necessary paperwork that the manager must give to prospective investors.

Juniper keygenguru. Juniper keygenguru Once you have connected your device to your PC, Smart Detect detects it and sets the optimal output formats. (former KeygenGuru). Juniper Networks Odyssey Access Client Manager v5 20 14913 0. Juniper Network Odyssey Access Client v4.7. Solarwinds Orion 10 3 Keygenguru. Mario Kart Double Dash Isotoner Juniper Keygenguru Newsleecher 5 Beta 6 Rapidshare Movies. Juniper Keygenguru. When whiny liberals want to know why president obama should be impeached, show them this list of 21 impeachable offenses.

The offering documents will look very similar to a mutual fund prospectus. The three parts of the offering documents are:. The private placement memorandum (also sometimes called the offering memorandum). The private placement memorandum (also known as the “PPM”), is the main offering document.

Hedge Fund Prospectus Templates Microsoft Outlook

It provides the prospective investor with information on the structural and business aspects of the fund. The limited partnership agreement (or, if the fund is an LLC, the operating agreement). The limited partnership agreement (also known as the “LPA”), is the actual governing legal document. It provides a description of the rights of the investors and the manager. When an investor becomes a “partner” in the fund, the investor is executing the limited partnership agreement. The subscription documents. The subscription documents are the documents which provide the manager with background information on the investor.

These documents include assurance and warranties by the potential investor that the potential investor is qualified to invest in the offering. These documements usually include the signature page to the LPA.A more in depth description of the potential parts of the offering documents follows:Private Placement MemorandumWhile each law firm’s general PPM template is different, they all share many of the same items of information which are included.